If you woke up this morning and noticed that your favorite OTC stock was not trading, nor had market makers showing on Level 2 trading platforms, you are not alone. It looks as though the entire OTC Markets is experiencing a data overload issue early in trading Thursday.

This comes on the same day that the Twitter IPO is set to commence. Although likely unrelated, it is interesting the timing of the trading issues with the OTC Markets as Mortgage behemoths Fannie Mae and Freddie Mac reported profitable quarters and are expected to pay the US dividends of $8.5b and $30.4b respectively.

At the time of this post, there was not any information available on the OTC Markets website to further explain the technical issues this morning. Stay tuned...

Thursday, November 7, 2013

Wednesday, November 6, 2013

Thoughts on Tesla Motors Share Price

Tesla Motors reported earnings today and the companies stock price continued it's descent since the 52-week high on September 30th of $194.50. The stock has lost nearly 25% since its 52-week high.

For those that read financial message boards, analyst reports, and even tweets about the company, the overarching sentiment is that the companies share price is substantially inflated. As it stands, the companies Market Cap of $18.5 billion puts it trading at a multiple of 11 times it's current sales. Today the company reported quarterly sales of $430 million suffering a loss of $38 million.

For a quick comparison of what other car manufacturers trade at, let's look at GM and Honda both trade at 30% of sales and 70% of sales, respectively. Thus, the 11 times sales for Tesla has likely inflated the companies valuation. Based on the competitors, the multiple should be substantially lower for Tesla, but since Tesla has tremendous growth potential don't expect them to trade the same multiple as these establish brands (just yet anyways).

It is likely the current trading has been on expectations for the companies future. They are building a solid brand and the company has experience tremendous demand for their Tesla Model S cars. Thus, the company has the basics in place to continue with their rapid growth. However, until the company can meet this demand by building the necessary infrastructure, the companies stock price is likely to continue to decline as this infrastructure will likely lead to losses over the next few quarters.

After seeing the recent price decline and trading action for Tesla, what are your thoughts on the future? Where will the bottom be for this stock price? Please share your thoughts.

For those that read financial message boards, analyst reports, and even tweets about the company, the overarching sentiment is that the companies share price is substantially inflated. As it stands, the companies Market Cap of $18.5 billion puts it trading at a multiple of 11 times it's current sales. Today the company reported quarterly sales of $430 million suffering a loss of $38 million.

For a quick comparison of what other car manufacturers trade at, let's look at GM and Honda both trade at 30% of sales and 70% of sales, respectively. Thus, the 11 times sales for Tesla has likely inflated the companies valuation. Based on the competitors, the multiple should be substantially lower for Tesla, but since Tesla has tremendous growth potential don't expect them to trade the same multiple as these establish brands (just yet anyways).

It is likely the current trading has been on expectations for the companies future. They are building a solid brand and the company has experience tremendous demand for their Tesla Model S cars. Thus, the company has the basics in place to continue with their rapid growth. However, until the company can meet this demand by building the necessary infrastructure, the companies stock price is likely to continue to decline as this infrastructure will likely lead to losses over the next few quarters.

After seeing the recent price decline and trading action for Tesla, what are your thoughts on the future? Where will the bottom be for this stock price? Please share your thoughts.

Monday, November 4, 2013

SAC Capital Advisors Pleads Guilty: 7 Years Is Way Too Long

SAC Capital Advisors today plead guilty to insider trading. This is music to my ears! This has been known for several years and the SEC, as usual, is too slow to react.

This recent case opens the possibility that he, Steven A. Cohen, may be held personally liable.

This recent case opens the possibility that he, Steven A. Cohen, may be held personally liable.

Sunday, October 27, 2013

IPO Talk: Twitter Takes Center Stage

Did you just step aside from your Twitter account to check out this article about the Twitter IPO? If you did, your tweets have been contributing to the hype of this latest social media IPO. Yes, your latest 140 characters have made Twitter that much more popular. Whether you tweet about stocks or tweet about your latest meal, the Twitter IPO is sure to garner your attention.

Twitter recently announced that they were going public not from an official press release, but from a 140 character or less tweet.

Yes, Twitter officially announced going public via the platform that has over 218.3 million active users, according to TechCrunch.com.

Early indications suggest that the company is planning to sell shares around $17 to $20, which would put the amount raised at around $1.6 million if they sell about 80 million shares. Wall Street analyst have stated that Twitter will have around 545 million shares outstanding, thus a $20 estimate would value the company at $10.9 billion. According to PrivCo, Twitter is expected to make $500 million in revenue up from 2012 when Twitter saw revenue of $245 million. Going into the IPO this actually seems quite reasonable since Facebook looks about 20x price to sales.

So is Twitter the next hyped IPO? Possibly. It is really up to the business model that Twitter defines in their SEC filings. Are they capable of growth and gaining revenue via advertisements and paid sponsorship of Twitter tweets? The initial future looks relatively bright, but what's troublesome is their technology. For the most part, this technology can be replicated since Twitter does not have a patent to protect their 140 character tweets. The barriers to entry are minimal and companies that want to replicate the success and utilize the Twitter technology can do so. Thus, it will be interesting to see what the company releases in their IPO filings regarding the future of the company.

So what can you expect from Twitter's IPO? A lot of hype!

Therefore, Day 1 will likely be up, as anything below the IPO price will initiate lawsuits, so traders can potentially make gains on Twitter's IPO just like many did on Day 1 of Facebook's IPO.

As far as Twitter's future, I would expect to see the company maintain significant growth over the next few years.

In related news, it looks like the NYSE is preparing for the Twitter IPO. It would be nice to avoid the start of Facebook's IPO, which was delayed nearly 30 minutes.

Twitter recently announced that they were going public not from an official press release, but from a 140 character or less tweet.

We’ve confidentially submitted an S-1 to the SEC for a planned IPO. This Tweet does not constitute an offer of any securities for sale.

— Twitter (@twitter) September 12, 2013

Yes, Twitter officially announced going public via the platform that has over 218.3 million active users, according to TechCrunch.com.

Early indications suggest that the company is planning to sell shares around $17 to $20, which would put the amount raised at around $1.6 million if they sell about 80 million shares. Wall Street analyst have stated that Twitter will have around 545 million shares outstanding, thus a $20 estimate would value the company at $10.9 billion. According to PrivCo, Twitter is expected to make $500 million in revenue up from 2012 when Twitter saw revenue of $245 million. Going into the IPO this actually seems quite reasonable since Facebook looks about 20x price to sales.

So is Twitter the next hyped IPO? Possibly. It is really up to the business model that Twitter defines in their SEC filings. Are they capable of growth and gaining revenue via advertisements and paid sponsorship of Twitter tweets? The initial future looks relatively bright, but what's troublesome is their technology. For the most part, this technology can be replicated since Twitter does not have a patent to protect their 140 character tweets. The barriers to entry are minimal and companies that want to replicate the success and utilize the Twitter technology can do so. Thus, it will be interesting to see what the company releases in their IPO filings regarding the future of the company.

So what can you expect from Twitter's IPO? A lot of hype!

Therefore, Day 1 will likely be up, as anything below the IPO price will initiate lawsuits, so traders can potentially make gains on Twitter's IPO just like many did on Day 1 of Facebook's IPO.

As far as Twitter's future, I would expect to see the company maintain significant growth over the next few years.

In related news, it looks like the NYSE is preparing for the Twitter IPO. It would be nice to avoid the start of Facebook's IPO, which was delayed nearly 30 minutes.

Friday, October 25, 2013

MVP OTC Stock Contest - Week #42 - SEEK Winning Alert

Congratulations to Hammer1 for winning the 2013 MVP OTC Contest #42!

SEEK was alerted by Hammer1 at $0.0015 and reached a week high today of $0.0044 for an MVP contest gain of 193.33%!

In second place, TDEY alerted by Big Tuna at $0.0085 and reached a week high of $0.0019 for an MVP contest gain of 123.53%.

Rounding out the top 3 was FNMA alerted by Chartman17 at $1.555 and reached a week high of

$2.68 for an MVP contest gain of 72.35%.

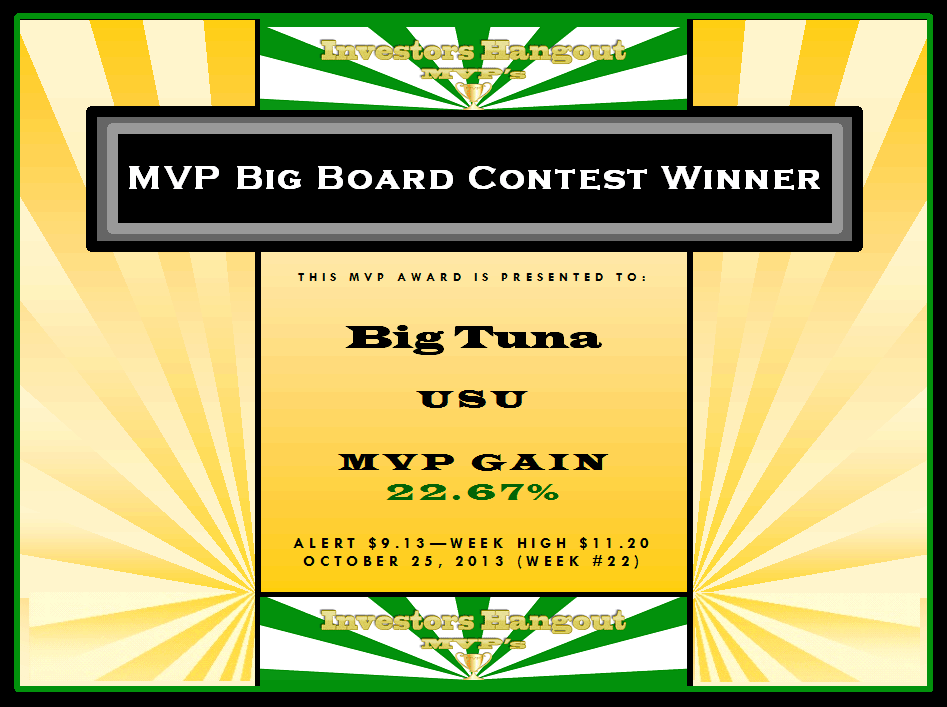

MVP Big Board Stock Contest - Week #22 - USU Winning Alert

Congratulations to Big Tuna for winning the 2013 MVP Big Board Contest #22!

USU was alerted by Big Tuna at $9.13 and reached a week high today of $11.20 for an MVP contest gain of 22.67%!

In second place, GWPH alerted by MattySimone at $27.95 and reached a week high of $32.7499 for an MVP contest gain of 17.17%.

Rounding out the top 3 was ABT alerted by RobInvest at $33.50 and reached a week high of

$37.62 for an MVP contest gain of 12.30%.

Wednesday, October 23, 2013

FMCC & FNMA Volume Alerts

Both the weekly and the daily charts on FMCC & FNMA have been setting up for a bullish run. This morning may be the start.

Only 30 minutes into the trading day both stocks are experience an increased volume of shares. FMCC is over 6M and FNMA is nearing 12M. Both stocks are trading up this morning.

With the release of their quarterly results upcoming, these next few months look to be an important determinant in the direction the companies will be taking. There has been a new company already registered that is being rumored to be the company that merges FMCC & FNMA, however, it will be up to the terms established in upcoming legislative bills that will determine whether or not this actually happens.

The last 5 minutes of trading:

FMCC traded 1M shares and is up to 11% early Wednesday

FNMA traded nearly 2M shares and is up 10% early Wednesday

Only 30 minutes into the trading day both stocks are experience an increased volume of shares. FMCC is over 6M and FNMA is nearing 12M. Both stocks are trading up this morning.

With the release of their quarterly results upcoming, these next few months look to be an important determinant in the direction the companies will be taking. There has been a new company already registered that is being rumored to be the company that merges FMCC & FNMA, however, it will be up to the terms established in upcoming legislative bills that will determine whether or not this actually happens.

The last 5 minutes of trading:

FMCC traded 1M shares and is up to 11% early Wednesday

FNMA traded nearly 2M shares and is up 10% early Wednesday

Friday, October 18, 2013

Investors Hangout MVP's - Contest Rules

We thought it would be fun to upload a short video highlighting the rules of our Weekly MVP OTC Contest and Bi-Weekly MVP Big Board Contest. This video just shows the very basics to get you started in submitted an eligible pick. Additional contest rules can be found on our MVP website by visiting this link:

OTC Contest

Big Board Contest

Submit your Quality OTC Stock picks in our weekly MVP OTC Contest and submit your Quality Big Board Stock picks in our Bi-Weekly MVP Big Board Contest. Contest submission periods start after the closing bell Friday and end Sunday 11:59PM ET. We welcome all entries into our contest. Stop by Investors Hangout where you can discuss the contest stocks and submit your weekly pick. http://investorshangoutmvp.com

Also, check out our website for Daily Contest Quotes, Updated Rankings, Stock Charts, DD, Stock Market Analysis and more!

http:// ihmvp.blogspot.com

OTC Contest

Big Board Contest

Submit your Quality OTC Stock picks in our weekly MVP OTC Contest and submit your Quality Big Board Stock picks in our Bi-Weekly MVP Big Board Contest. Contest submission periods start after the closing bell Friday and end Sunday 11:59PM ET. We welcome all entries into our contest. Stop by Investors Hangout where you can discuss the contest stocks and submit your weekly pick. http://investorshangoutmvp.com

Also, check out our website for Daily Contest Quotes, Updated Rankings, Stock Charts, DD, Stock Market Analysis and more!

http:// ihmvp.blogspot.com

Barriers to Small Business Growth

The CEO of the OTC Markets Mr. Coulson, addresses the House subcommittee on capital formation in June 2013. In his talking points he mentions several barriers to small business growth. The main point he discusses is the tax rates for small businesses and how their higher tax rates compared to larger corporate firms puts them at a capital disadvantage. In addition, he mentions that there should be additional transparency when it comes to who is behind trades.

Toxic Financing Deals: The Love of Short-Sellers

You may have come across an OTC stock over your years of trading and investing that had one of the worst combination for any OTC investor and the company for that matter. At some point the company decided to take on debt to finance operations, which included the rights of the debtor to call the debt due and have shares issued to cover the debt. This convertible debt is commonly referred to as toxic financing.

From an investors perspective it is relatively obvious how damaging this type of toxic financing can be to your investment. Once the debt is converted into shares of common stock, the sale in the public markets inevitably dilutes the percentage ownership of your shares in that company. The additional shares in the market, if not acquired by interested buyers, can depress the stock price. This form of dilution is music to the ears of short sellers who can have a tremendous impact on the stock price during the dilution.

Here is a basic scenario of what happens during periods of dilution, and the ultimate reason for a stock pps decline:

The solution to this problem needs to be addressed by the markets them self. Institutional investors, banks, and large retail investors do not like the risk involved with these types of companies. Thus, these companies have limited resources when it comes to raising financing. A desperate CEO will likely end up taking a toxic deal in the hopes that they can pay the debt prior to it maturing. When they can't, the market value of that company takes a huge hit.

Making additional financing options available to these small and micro-cap companies will help to address some of these market-related issues. Companies will take on less toxic financing and hopefully have better opportunities to grow their business.

From an investors perspective it is relatively obvious how damaging this type of toxic financing can be to your investment. Once the debt is converted into shares of common stock, the sale in the public markets inevitably dilutes the percentage ownership of your shares in that company. The additional shares in the market, if not acquired by interested buyers, can depress the stock price. This form of dilution is music to the ears of short sellers who can have a tremendous impact on the stock price during the dilution.

Here is a basic scenario of what happens during periods of dilution, and the ultimate reason for a stock pps decline:

- Dilutive MM shows up on the ask (e.g. BMAK or VFIN/VERT)

- MM's such as VFIN & VERT work in tandem to maximize the pps realized for the group or individual selling the stock.

- One shows on the bid to symbolize strength, while the other will show 10k on the ask so that those buying will buy at the ask instead of parking on the bid

- It might take a day or two for the market to realize that dilution is in fact taking place

- The chatter on stock message boards quickly changes

- New aliases show up touting the ill effects of this dilution, calling the company a scam, POS, and more

- This causes emotional investors to react irrationally selling into the bid

- Short-selling commences and often-times involves them jumping over the dilutive MM to sell shares to the interested buyers

- Then the walls on the ask show up to push the price lower to be able to cover

- If the dilutive MM is not finishing selling their shares, this cycle continues and the short-sellers can continue to depress the stock price

The solution to this problem needs to be addressed by the markets them self. Institutional investors, banks, and large retail investors do not like the risk involved with these types of companies. Thus, these companies have limited resources when it comes to raising financing. A desperate CEO will likely end up taking a toxic deal in the hopes that they can pay the debt prior to it maturing. When they can't, the market value of that company takes a huge hit.

Making additional financing options available to these small and micro-cap companies will help to address some of these market-related issues. Companies will take on less toxic financing and hopefully have better opportunities to grow their business.

Tuesday, October 15, 2013

Contest Update: Daily Volume Alerts & News Updates

We only have a few contest stocks that have news out today. FMCC is one stocks with the news being about how the government shutdown could affect the housing market, which is pretty obvious. The other stock with news was Nokia, which was mentioned in an article regarding Microsoft. The article talks about the rating for Microsoft, and mentioned the Nokia handset operation.

Contest Stocks with Volume Alerts:

NOK trading 32M+ shares, currently up 4.23%

ANDI trading 93M shares, currently even on the day

MINE trading 34M+ shares, currently up 22.73%

TDEY trading 51M shares, currently up 18.18%

TGGI trading at 180M+ shares, currently up 14.29%

Contest Stocks with Volume Alerts:

NOK trading 32M+ shares, currently up 4.23%

ANDI trading 93M shares, currently even on the day

MINE trading 34M+ shares, currently up 22.73%

TDEY trading 51M shares, currently up 18.18%

TGGI trading at 180M+ shares, currently up 14.29%

Friday, October 11, 2013

Investors Rejoice: An App is Coming for Savvy Investors

The investment community has long been looking for a legitimate alternative to iHub and we have found a suitable alternative.

Let the investment community rejoice, the time for a fair investors forum is here!

Investors Hangout is the new forum for investors to share investment ideas, post due diligence, and discuss current economic events.

Be sure to check out the IH App that is soon to be available on your mobile device. Check out the latest developments:

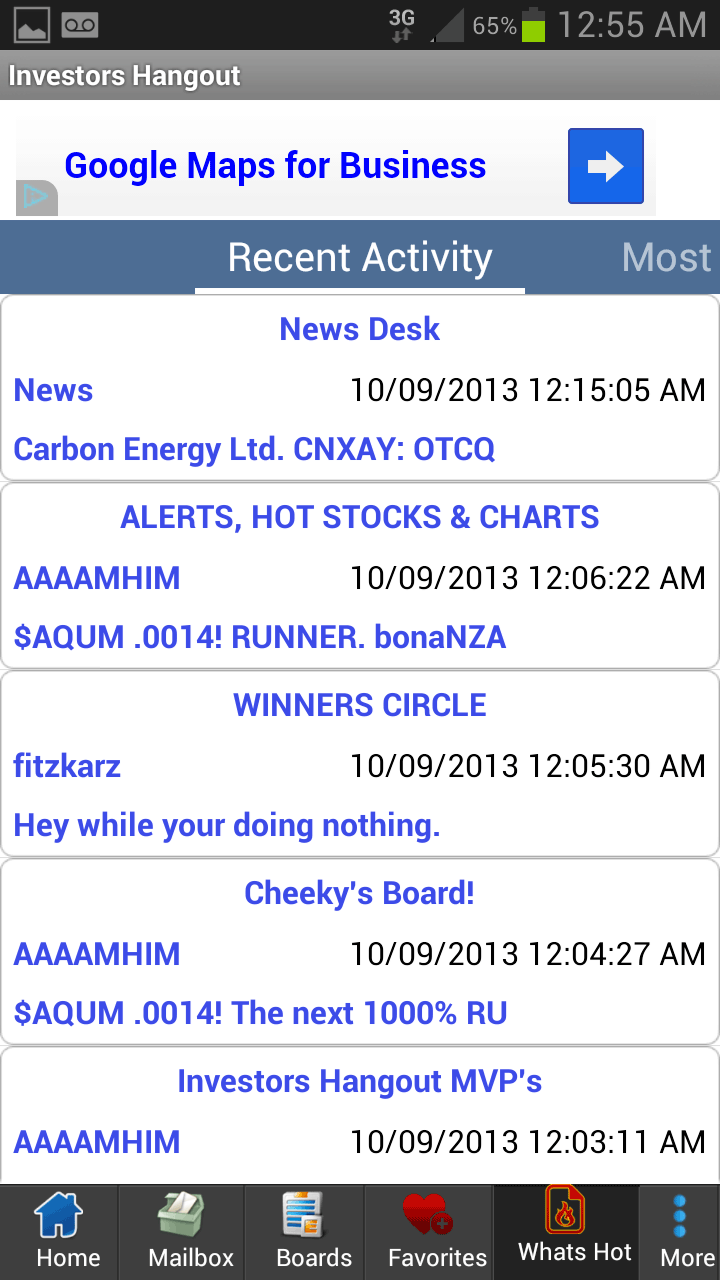

On the page shown to your left, you can go to any of the boards, or just swipe your finger from right to left on the screen to go to the next most active page.

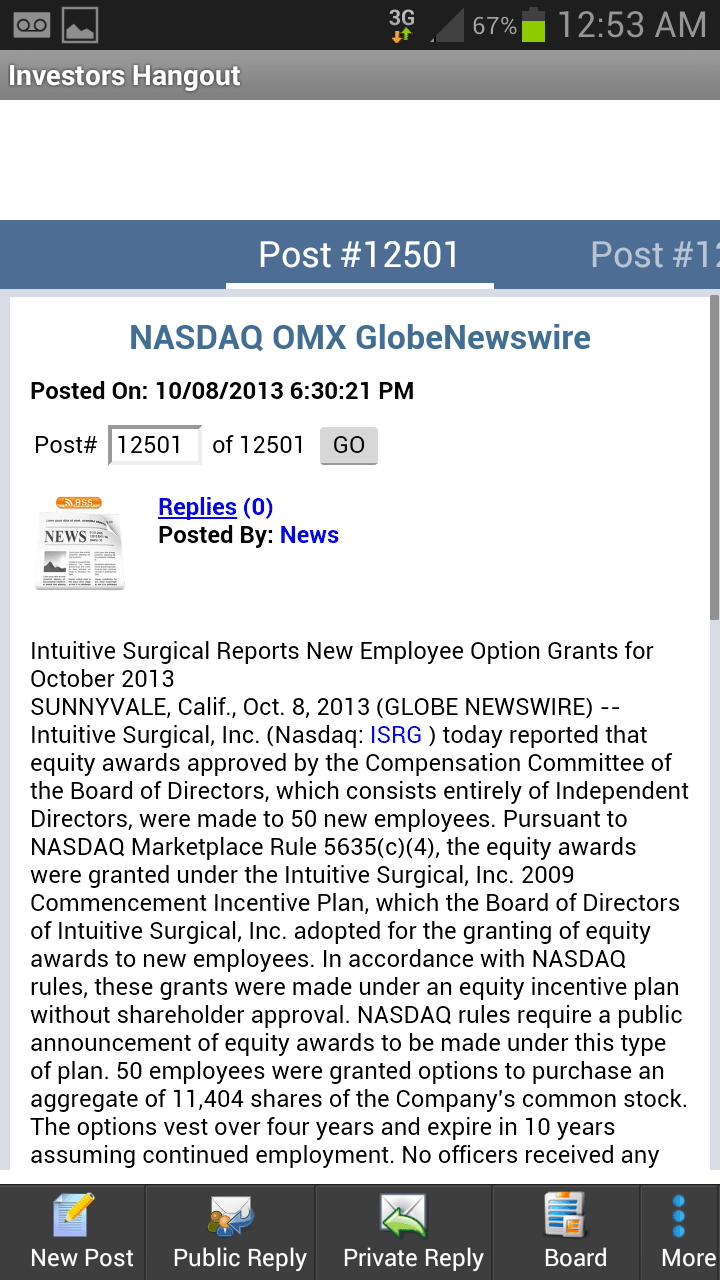

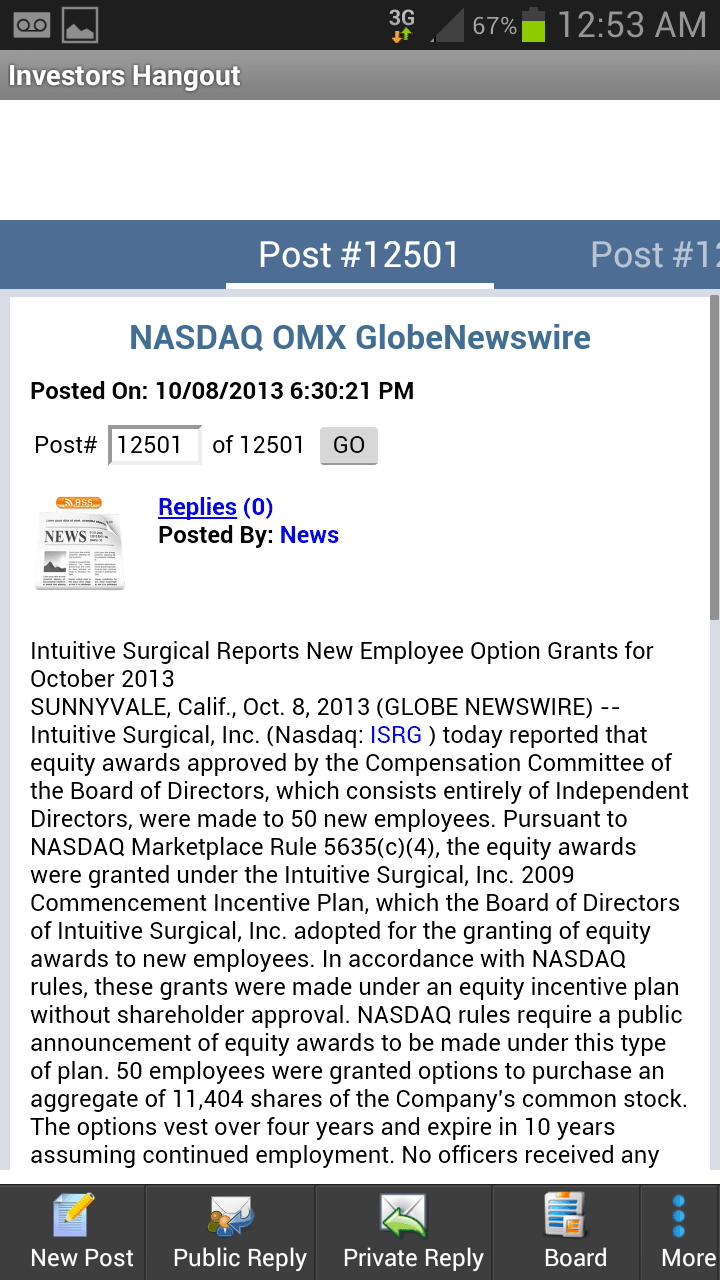

Here's a screen shot of the NASDAQ OMX GlobeNewswire Board.

You can scroll down and read the News descriptions until you see something that catches your eye, or you can just as easily read them all.

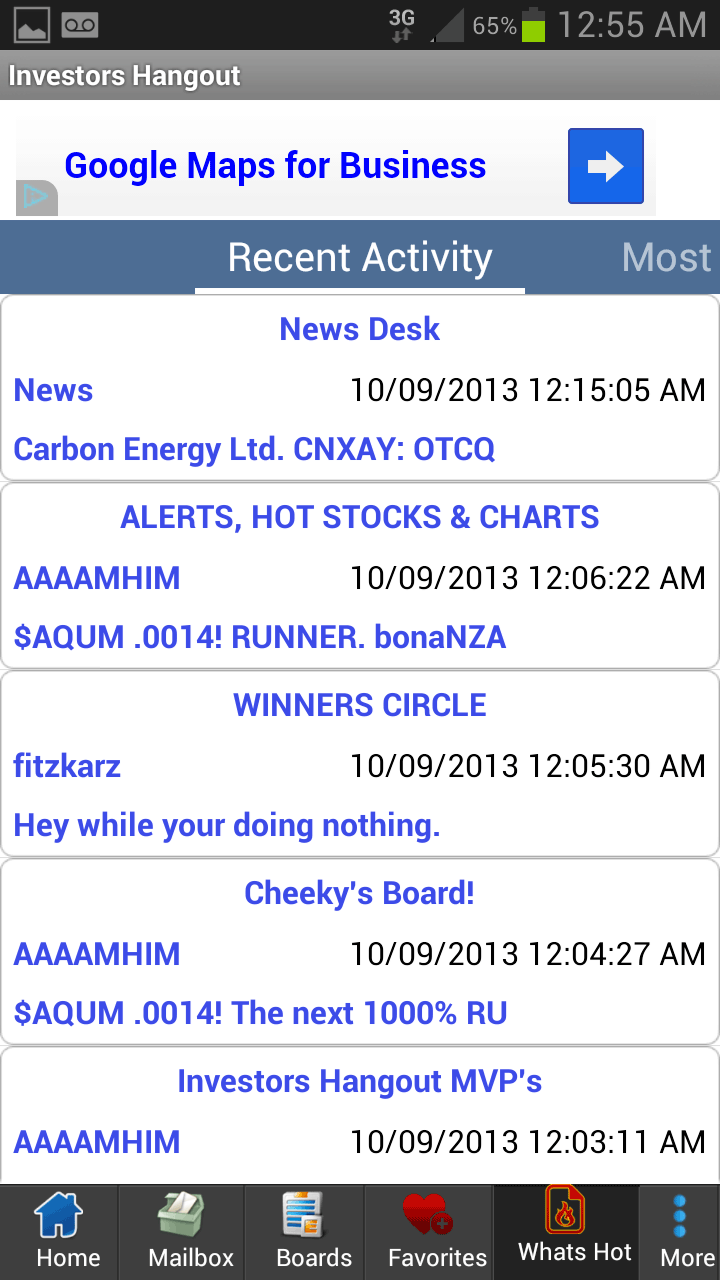

Here's a screen shot of the Most Recent Activity.

<---- Each post has three options.

1.) If you Touch the Board Name (ALERTS, HOT STOCKS & CHARTS), it will bring you to that Board.

2.) If you Touch the Members Alias (AAAAMHIM), it will bring you to the members profile page.

3.) If you Touch anywhere on the Post Description ($AQUM .0014! RUNNER. bonaNZA), it will bring you to the post.

* If you did click on the post description above, you can read post on the most recent by just swiping the screen. "

"

Let the investment community rejoice, the time for a fair investors forum is here!

Investors Hangout is the new forum for investors to share investment ideas, post due diligence, and discuss current economic events.

Be sure to check out the IH App that is soon to be available on your mobile device. Check out the latest developments:

"Here's a few screen shots from the upcoming Investors Hangout Apps.

On the page shown to your left, you can go to any of the boards, or just swipe your finger from right to left on the screen to go to the next most active page.

Here's a screen shot of the NASDAQ OMX GlobeNewswire Board.

You can scroll down and read the News descriptions until you see something that catches your eye, or you can just as easily read them all.

Here's a screen shot of the Most Recent Activity.

<---- Each post has three options.

1.) If you Touch the Board Name (ALERTS, HOT STOCKS & CHARTS), it will bring you to that Board.

2.) If you Touch the Members Alias (AAAAMHIM), it will bring you to the members profile page.

3.) If you Touch anywhere on the Post Description ($AQUM .0014! RUNNER. bonaNZA), it will bring you to the post.

* If you did click on the post description above, you can read post on the most recent by just swiping the screen.

MVP OTC Contest Results - Week #40 - TGGI Winning Stock

Congratulations to coffeenut for winning the 2013 MVP OTC Contest #40!

TGGI was alerted by coffeenut at $0.0003 and reached a week high today of $0.0014 for an MVP contest gain of 366.67%! TGGI was alerted at $0.0001, but the alert price is set at $0.0003 per contest rules. From the actual alert price the gains were 1,300%.

In second place, CBYI alerted by PoemStone at $0.0006 and reached a week high of $0.0016 for an MVP contest gain of 166.67%.

Rounding out the top 3 was PAWS alerted by PhilCheeze at $0.0149 and reached a week high of $0.029

for an MVP contest gain of 94.63%.

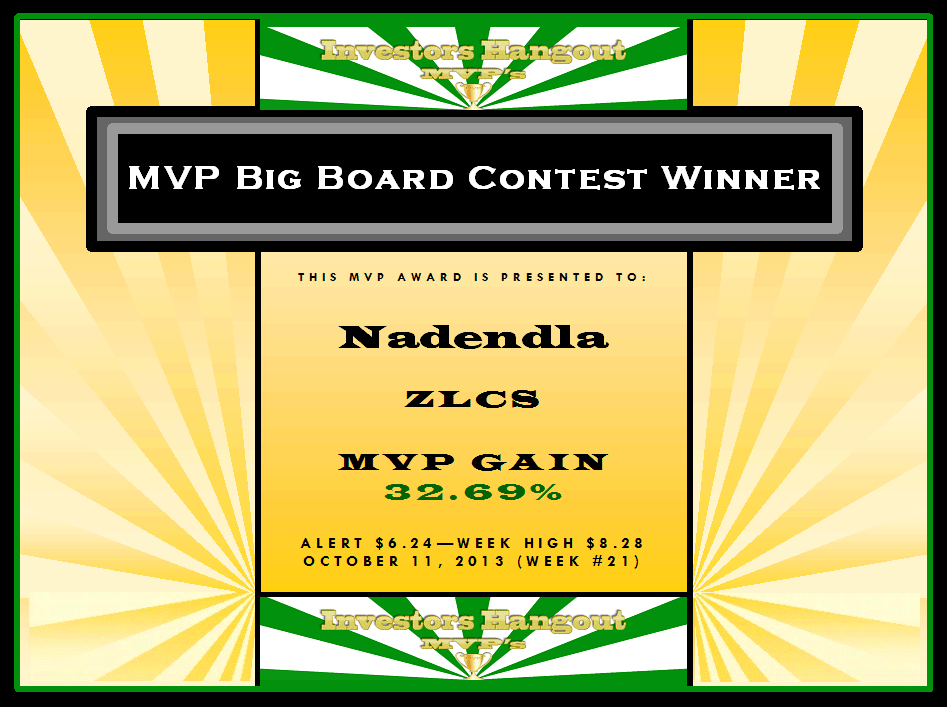

MVP Big Board Contest Results - Week #21 - Winning Stock ZLCS

Congratulations to Nadendla for winning the 2013 MVP Big Board Contest #21!

ZLCS was alerted by Nadendla at $6.24 and reached a week high today of $8.28 for an MVP contest gain of 32.69%!

In second place, RENN alerted by Chartman17 at $3.32 and reached a week high of $4.23 for an MVP contest gain of 27.41%.

Rounding out the top 3 was

KIOR alerted by PoemStone at $2.61 and reached a week high of $2.90

for an MVP contest gain of 11.11%.

Wednesday, October 9, 2013

Daily Contest Update: Volume Alerts & News

Let's start off with the stocks setting off volume alerts today in our stock contests:

NOK trading 28M+ shares this morning, down 3.33%

CBYI trading over 40M shares, even at $0.0002

FMCC trading 4M+ shares, up 0.65%

SBRH trading 30M+ shares, even at $0.0006

TGGI trading 65M+ shares, even at $0.0006

In addition to the aforementioned volume alerts, several stocks in the contest have released news:

PLUG: Senior Management will present at the California Hydrogen and Fuel Cell Summit, afterwhich a slideshow presentation will be available on their companies website.

S: The CEO of Sprint was named the 2013 Corporate Responsibility Lifetime Achievement Award Winner, which will be given out tonight at the 2013 COMMIT!Forum held in NY City.

FMCC: Annouced they will not issue a reference note security (see PR for more details)

SBRH: Was mentioned in a pennystock newsletter.

NOK trading 28M+ shares this morning, down 3.33%

CBYI trading over 40M shares, even at $0.0002

FMCC trading 4M+ shares, up 0.65%

SBRH trading 30M+ shares, even at $0.0006

TGGI trading 65M+ shares, even at $0.0006

In addition to the aforementioned volume alerts, several stocks in the contest have released news:

PLUG: Senior Management will present at the California Hydrogen and Fuel Cell Summit, afterwhich a slideshow presentation will be available on their companies website.

S: The CEO of Sprint was named the 2013 Corporate Responsibility Lifetime Achievement Award Winner, which will be given out tonight at the 2013 COMMIT!Forum held in NY City.

FMCC: Annouced they will not issue a reference note security (see PR for more details)

SBRH: Was mentioned in a pennystock newsletter.

Tuesday, October 8, 2013

Daily Contest Watch - Volume Alerts & News

Quick summary: About half the OTC contest stocks are currently trading in positive territory, volume alerts also on 5 stocks, 1 stock (and 3 stocks featured in newsletters) with news today in the OTC contest and 2 with news in the Big Board contest. The overall market is trading lower with the DJIA going below 14,900. The government shutdown is still in effect.

OTC Contest Volume Alerts

CBYI: Nearly 270M shares traded, down 66.67%

GLER: Over 25M shares traded, down 17.65%

SBRH: Over 72M shares traded, stock is even today

TDEY: Over 25M shares traded, stock is down 1.96%

TGGI: Over 300M shares traded, stock is currently up 33.33%

OTC Contest Stocks with News

TDEY: Litigation between Mr. Sharp and 3D Entertainment Holdings, Inc are winding down as both sides have apparently agreed to settle differences as addressed in the case.

EWSI, QLTS, and TGGI were all featured in stock newsletters.

OTC Contest Volume Alerts

CBYI: Nearly 270M shares traded, down 66.67%

GLER: Over 25M shares traded, down 17.65%

SBRH: Over 72M shares traded, stock is even today

TDEY: Over 25M shares traded, stock is down 1.96%

TGGI: Over 300M shares traded, stock is currently up 33.33%

OTC Contest Stocks with News

TDEY: Litigation between Mr. Sharp and 3D Entertainment Holdings, Inc are winding down as both sides have apparently agreed to settle differences as addressed in the case.

EWSI, QLTS, and TGGI were all featured in stock newsletters.

Monday, October 7, 2013

FMCC Weekly Chart - Bullish Patterns

The weekly chart on FMCC is starting to become rather bullish. The weekly technical signals are showing many of the indicators turning bullish, nearing positive territory or already bullish. The bollinger bands are pinching on the weekly, which could give rise to a price appreciation if the trading breaks through the top bollinger band. These technical signals are inline with upcoming filings by both Fannie Mae and Freddie Mac expected sometime in November. Positive news, along with technicals, as seen in the weekly FMCC, will likely help the price appreciation expected by those currently holding shares or buying leading up to the financials. There is still much in the way of proving that FMCC will remain viable in the long-run (i.e. won't be disbanned by the gov't), but the technicals are bullish at this time.

FMCC Weekly Chart1

Disclosure: This is not a solicitation to buy or sell the stock mentioned above. This is simply to feature a stock and it's trading technicals.

Additional analysis can be mentioned in the comments section below.

FMCC Weekly Chart1

Disclosure: This is not a solicitation to buy or sell the stock mentioned above. This is simply to feature a stock and it's trading technicals.

Additional analysis can be mentioned in the comments section below.

This weeks stock contest summary and volume alerts

Volume Alerts for Contest Stocks (October 7, 2013 a/o post time):

CBYI - 1,793,686,210 down 77.78%

SBRH - 170,323,125 up 50%

TGGI - 493,433,232 up 300%

Analysis below provided by Bodach for this weeks contest:

What a week this will be for the MVP picks!!! These are some gems.

ACLP -- Read RIPPERS DD notes to find out why.

CBYI -- will probably gap down hard and run. Play carefully and make some huge profits, imo. Besides my own pick, this is what I think will win this week via the gap down and expected volatility afterwards.

EWSI -- dilutive MMs gone. VFIN VNDM and MAXM laid off as of Thursday. People will want to get back in before the monster Q3. Great long play as well.

GLER -- I think it's more of a pump, but should certainly see a great spike, imo. Trade carefully, and profit big.

MINE -- due for the next big leg up.

XNRG -- if dilution verifiably ends, it can correct back to 2-week ago prices, thus a 100%+ gain. Solid pick!

Read More: http://investorshangout.com/post/1009408/What-a-week-this-will-be-for-the-MVP-picks-These-a#ixzz2h3TCwUW6 More on the Stock Market

CBYI - 1,793,686,210 down 77.78%

SBRH - 170,323,125 up 50%

TGGI - 493,433,232 up 300%

Analysis below provided by Bodach for this weeks contest:

What a week this will be for the MVP picks!!! These are some gems.

ACLP -- Read RIPPERS DD notes to find out why.

CBYI -- will probably gap down hard and run. Play carefully and make some huge profits, imo. Besides my own pick, this is what I think will win this week via the gap down and expected volatility afterwards.

EWSI -- dilutive MMs gone. VFIN VNDM and MAXM laid off as of Thursday. People will want to get back in before the monster Q3. Great long play as well.

GLER -- I think it's more of a pump, but should certainly see a great spike, imo. Trade carefully, and profit big.

MINE -- due for the next big leg up.

XNRG -- if dilution verifiably ends, it can correct back to 2-week ago prices, thus a 100%+ gain. Solid pick!

Read More: http://investorshangout.com/post/1009408/What-a-week-this-will-be-for-the-MVP-picks-These-a#ixzz2h3TCwUW6 More on the Stock Market

Sunday, October 6, 2013

Investors Hangout MVP OTC Stock Contest

IH MVP OTC Contest Rules

1. The alert must be made on this board beginning 4:01PM ET Friday and prior to the start of trading at 11:59AM ET Sunday.

2. Contest picks should include: stock name, current price and any

accompanying DD. Please use this format when posting a contest pick: Example - "MVP pick ABCD $0.01 Link to DD or DD text"

3. Members are limited to one (1) contest pick each week and should be posted using the format mentioned in Rule #2. Note: additional picks will not count towards the contest, but may be posted for discussion.

4. The one (1) contest pick will be eligible for the respective week of trading.

5. Contest picks are judged using the open price for the week as the baseline.

6. Contest winning stocks must gain 100% at any given point during the week based on the price at alert.

Example: ABCD is alerted at $0.01 Monday and is trading at $0.02

Wednesday mid-trading day, since the pick gained equal to or greater

than 100% since the stock was alerted this pick will win the contest for

that week.

7. There will be only one (1) MVP winner each week. Best percentage

gain at any given time during the week, regardless of the end of the

week price, above 100% wins MVP contest for the week.

8. Minimum stock price for entry into the contest is $0.0003.

9. Minimum volume for all stocks under $0.001 is 2,000,000 shares.

Cheap and low volume shares do not qualify. All moderators will have

final word whether the stocks volume is eligible.

10. Manipulation of stocks to win contest is prohibited. All moderators

will monitor stock picks for pump and dump schemes, frontloading of

stock picks, etc..

11. IH MVP members should remain professional and respectful of other

members picks. Discussion is welcome for all picks, but bashing and

profanity is prohibited.

12. Each week represents a new contest. Picks should be announced to the board during the hours mentioned in Rule #1.

13. Members may not have the same pick as another member.

14. In the event 2 members post the same pick, the member that had

announced it first to the board is granted eligibility for that pick.

Investors Hangout MVP Big Board Stock Contest

IH MVP Big Board Contest Rules

1. The alert must be made on this board beginning 4:01PM ET Friday and prior to the start of trading at 11:59AM ET Sunday.

2. The contest lasts for two (2) weeks, therefore, shall be referenced as a bi-weekly contest.

3. Contest picks should include: stock name, current price and any

accompanying DD. Please use this format when posting a contest pick: Example - "MVP pick ABCD $1.00 Link to DD or DD text"

4. Members are limited to one (1) contest pick each contest and should be posted using the format mentioned in Rule #3. Note: additional picks will not count towards the contest, but may be posted for discussion.

5. The one (1) contest pick will be eligible for the respective two (2) weeks of trading.

6. Contest picks are judged using the alerted price as the baseline.

7. Contest winning stocks must gain 15% at any given point during the week based on the price at alert.

Example: ABCD is alerted at $1.00 Monday and is trading at $1.16

Wednesday mid-trading day, since the pick gained equal to or greater

than 15% since the stock was alerted this pick will win the contest for

that week.

8. There will be only one (1) MVP winner each week. Best percentage

gain at any given time during the week, regardless of the end of the

week price, above 15% wins MVP contest for the week.

9. Minimum stock price for entry into the contest is $1.00.

10. Trading volume must equal a minimum of $10,000.

11. IH MVP members should remain professional and respectful of other

members picks. Discussion is welcome for all picks, but bashing and

profanity is prohibited.

12. Each two (2) weeks represents a new contest. Picks should be announced to the board during the hours mentioned in Rule #1.

13. Members may not have the same pick as another member.

14. In the event 2 members post the same pick, the member that had

announced it first to the board is granted eligibility for that pick.

15. In the event that the contest receives less than ten (10)

participants, an MVP award will not be given out for that contest. The

contest will still proceed with all participants to allow MVP members to

still make money off of the alerts if they so choose.

16. The contest is limited to "Big Board" stocks, here defined as being

non-OTC markets exchange stocks. Please check with a moderator if you

are unsure if your stock meets this requirement. Examples: Nasdaq,

NYSE, AMEX, Equivalent Foreign Exchanges. Note: Stocks are not limited

to the example exchanges, but must not be OTC market stocks (i.e.

Pinksheets, OTCBB, OTCQB, OTCQX).

2013 Investors Hangout MVP Portfolio Challenge

Rules:

1. Each MVP member picks up to 5 stocks, from any exchange and any combination of exchanges, to create an MVP portfolio. (note: index funds and mutual funds are not eligible)

2. Contest picks will be accepted until 11:59PM ET Sunday, January 6, 2013.

3. The contest begins Monday, January 7, 2013 (the first full trading week in 2013).

4. The contest ends Friday, December 20, 2013 (the last full trading week in 2013).

5. Each member is allowed one portfolio.

6. Alert price is based on the opening price Monday, January 7, 2013, as pre-market trading may occur prior to the opening bell January 7th.

7. Portfolio gains will be calculated by adding up the individual gains from each stock within the portfolio to create one percentage.

8. 2 MVP awards will be handed out:

- 1st MVP Award - winner based on the high for each stock in 2013. OTC stocks with quick gains that may not sustain pps may be a good option for attempting to win this MVP award.

- 2nd MVP Award - winner based on the percentage gains from opening price Jan. 7th to closing price on Dec. 20th. Big Board stocks that better sustain pps may be a good option for attempting to win this MVP award.

Note: you do not have to declare the award you are attempting to win...do consider your strategy prior to alerting your 5 stocks.

About Us

Investors Hangout MVP's Board Description

Investors Hangout MVP's was created to honor members that pick stocks

that close up more than 100% in a given trading day. This board was

created to inspire investors to find stocks that will realize huge

ROI's. Ideally, we seek stocks whose price per share will continue to

rise and/or be sustained for multiple months and years to bring

additional value to the investors.

Investos Hangout MVP's Philosophy

We believe that stocks achieving gains of greater than 100% will lead

to financial success. Our attempt at recognizing qualified stock picks

is to highlight the importance of scanning the markets for future

successful publicly traded companies. We acknowledge that due diligence

coupled with the right timing can be a key to success. Investing

responsibly and studying the markets will foster financial growth and

individual success.

Subscribe to:

Posts (Atom)