If you woke up this morning and noticed that your favorite OTC stock was not trading, nor had market makers showing on Level 2 trading platforms, you are not alone. It looks as though the entire OTC Markets is experiencing a data overload issue early in trading Thursday.

This comes on the same day that the Twitter IPO is set to commence. Although likely unrelated, it is interesting the timing of the trading issues with the OTC Markets as Mortgage behemoths Fannie Mae and Freddie Mac reported profitable quarters and are expected to pay the US dividends of $8.5b and $30.4b respectively.

At the time of this post, there was not any information available on the OTC Markets website to further explain the technical issues this morning. Stay tuned...

Thursday, November 7, 2013

Wednesday, November 6, 2013

Thoughts on Tesla Motors Share Price

Tesla Motors reported earnings today and the companies stock price continued it's descent since the 52-week high on September 30th of $194.50. The stock has lost nearly 25% since its 52-week high.

For those that read financial message boards, analyst reports, and even tweets about the company, the overarching sentiment is that the companies share price is substantially inflated. As it stands, the companies Market Cap of $18.5 billion puts it trading at a multiple of 11 times it's current sales. Today the company reported quarterly sales of $430 million suffering a loss of $38 million.

For a quick comparison of what other car manufacturers trade at, let's look at GM and Honda both trade at 30% of sales and 70% of sales, respectively. Thus, the 11 times sales for Tesla has likely inflated the companies valuation. Based on the competitors, the multiple should be substantially lower for Tesla, but since Tesla has tremendous growth potential don't expect them to trade the same multiple as these establish brands (just yet anyways).

It is likely the current trading has been on expectations for the companies future. They are building a solid brand and the company has experience tremendous demand for their Tesla Model S cars. Thus, the company has the basics in place to continue with their rapid growth. However, until the company can meet this demand by building the necessary infrastructure, the companies stock price is likely to continue to decline as this infrastructure will likely lead to losses over the next few quarters.

After seeing the recent price decline and trading action for Tesla, what are your thoughts on the future? Where will the bottom be for this stock price? Please share your thoughts.

For those that read financial message boards, analyst reports, and even tweets about the company, the overarching sentiment is that the companies share price is substantially inflated. As it stands, the companies Market Cap of $18.5 billion puts it trading at a multiple of 11 times it's current sales. Today the company reported quarterly sales of $430 million suffering a loss of $38 million.

For a quick comparison of what other car manufacturers trade at, let's look at GM and Honda both trade at 30% of sales and 70% of sales, respectively. Thus, the 11 times sales for Tesla has likely inflated the companies valuation. Based on the competitors, the multiple should be substantially lower for Tesla, but since Tesla has tremendous growth potential don't expect them to trade the same multiple as these establish brands (just yet anyways).

It is likely the current trading has been on expectations for the companies future. They are building a solid brand and the company has experience tremendous demand for their Tesla Model S cars. Thus, the company has the basics in place to continue with their rapid growth. However, until the company can meet this demand by building the necessary infrastructure, the companies stock price is likely to continue to decline as this infrastructure will likely lead to losses over the next few quarters.

After seeing the recent price decline and trading action for Tesla, what are your thoughts on the future? Where will the bottom be for this stock price? Please share your thoughts.

Monday, November 4, 2013

SAC Capital Advisors Pleads Guilty: 7 Years Is Way Too Long

SAC Capital Advisors today plead guilty to insider trading. This is music to my ears! This has been known for several years and the SEC, as usual, is too slow to react.

This recent case opens the possibility that he, Steven A. Cohen, may be held personally liable.

This recent case opens the possibility that he, Steven A. Cohen, may be held personally liable.

Sunday, October 27, 2013

IPO Talk: Twitter Takes Center Stage

Did you just step aside from your Twitter account to check out this article about the Twitter IPO? If you did, your tweets have been contributing to the hype of this latest social media IPO. Yes, your latest 140 characters have made Twitter that much more popular. Whether you tweet about stocks or tweet about your latest meal, the Twitter IPO is sure to garner your attention.

Twitter recently announced that they were going public not from an official press release, but from a 140 character or less tweet.

Yes, Twitter officially announced going public via the platform that has over 218.3 million active users, according to TechCrunch.com.

Early indications suggest that the company is planning to sell shares around $17 to $20, which would put the amount raised at around $1.6 million if they sell about 80 million shares. Wall Street analyst have stated that Twitter will have around 545 million shares outstanding, thus a $20 estimate would value the company at $10.9 billion. According to PrivCo, Twitter is expected to make $500 million in revenue up from 2012 when Twitter saw revenue of $245 million. Going into the IPO this actually seems quite reasonable since Facebook looks about 20x price to sales.

So is Twitter the next hyped IPO? Possibly. It is really up to the business model that Twitter defines in their SEC filings. Are they capable of growth and gaining revenue via advertisements and paid sponsorship of Twitter tweets? The initial future looks relatively bright, but what's troublesome is their technology. For the most part, this technology can be replicated since Twitter does not have a patent to protect their 140 character tweets. The barriers to entry are minimal and companies that want to replicate the success and utilize the Twitter technology can do so. Thus, it will be interesting to see what the company releases in their IPO filings regarding the future of the company.

So what can you expect from Twitter's IPO? A lot of hype!

Therefore, Day 1 will likely be up, as anything below the IPO price will initiate lawsuits, so traders can potentially make gains on Twitter's IPO just like many did on Day 1 of Facebook's IPO.

As far as Twitter's future, I would expect to see the company maintain significant growth over the next few years.

In related news, it looks like the NYSE is preparing for the Twitter IPO. It would be nice to avoid the start of Facebook's IPO, which was delayed nearly 30 minutes.

Twitter recently announced that they were going public not from an official press release, but from a 140 character or less tweet.

We’ve confidentially submitted an S-1 to the SEC for a planned IPO. This Tweet does not constitute an offer of any securities for sale.

— Twitter (@twitter) September 12, 2013

Yes, Twitter officially announced going public via the platform that has over 218.3 million active users, according to TechCrunch.com.

Early indications suggest that the company is planning to sell shares around $17 to $20, which would put the amount raised at around $1.6 million if they sell about 80 million shares. Wall Street analyst have stated that Twitter will have around 545 million shares outstanding, thus a $20 estimate would value the company at $10.9 billion. According to PrivCo, Twitter is expected to make $500 million in revenue up from 2012 when Twitter saw revenue of $245 million. Going into the IPO this actually seems quite reasonable since Facebook looks about 20x price to sales.

So is Twitter the next hyped IPO? Possibly. It is really up to the business model that Twitter defines in their SEC filings. Are they capable of growth and gaining revenue via advertisements and paid sponsorship of Twitter tweets? The initial future looks relatively bright, but what's troublesome is their technology. For the most part, this technology can be replicated since Twitter does not have a patent to protect their 140 character tweets. The barriers to entry are minimal and companies that want to replicate the success and utilize the Twitter technology can do so. Thus, it will be interesting to see what the company releases in their IPO filings regarding the future of the company.

So what can you expect from Twitter's IPO? A lot of hype!

Therefore, Day 1 will likely be up, as anything below the IPO price will initiate lawsuits, so traders can potentially make gains on Twitter's IPO just like many did on Day 1 of Facebook's IPO.

As far as Twitter's future, I would expect to see the company maintain significant growth over the next few years.

In related news, it looks like the NYSE is preparing for the Twitter IPO. It would be nice to avoid the start of Facebook's IPO, which was delayed nearly 30 minutes.

Friday, October 25, 2013

MVP OTC Stock Contest - Week #42 - SEEK Winning Alert

Congratulations to Hammer1 for winning the 2013 MVP OTC Contest #42!

SEEK was alerted by Hammer1 at $0.0015 and reached a week high today of $0.0044 for an MVP contest gain of 193.33%!

In second place, TDEY alerted by Big Tuna at $0.0085 and reached a week high of $0.0019 for an MVP contest gain of 123.53%.

Rounding out the top 3 was FNMA alerted by Chartman17 at $1.555 and reached a week high of

$2.68 for an MVP contest gain of 72.35%.

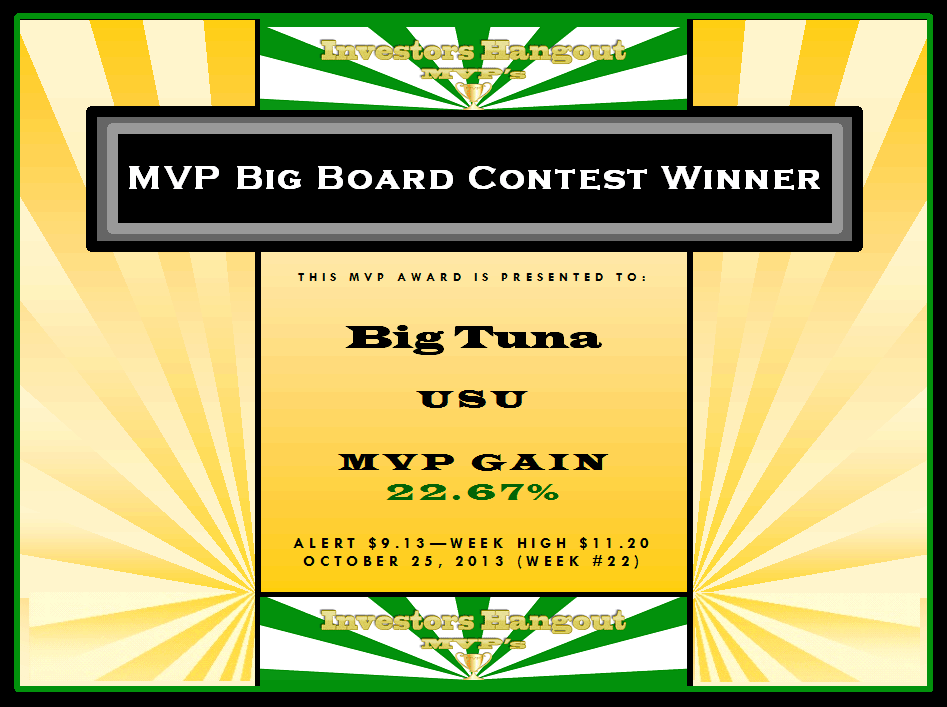

MVP Big Board Stock Contest - Week #22 - USU Winning Alert

Congratulations to Big Tuna for winning the 2013 MVP Big Board Contest #22!

USU was alerted by Big Tuna at $9.13 and reached a week high today of $11.20 for an MVP contest gain of 22.67%!

In second place, GWPH alerted by MattySimone at $27.95 and reached a week high of $32.7499 for an MVP contest gain of 17.17%.

Rounding out the top 3 was ABT alerted by RobInvest at $33.50 and reached a week high of

$37.62 for an MVP contest gain of 12.30%.

Wednesday, October 23, 2013

FMCC & FNMA Volume Alerts

Both the weekly and the daily charts on FMCC & FNMA have been setting up for a bullish run. This morning may be the start.

Only 30 minutes into the trading day both stocks are experience an increased volume of shares. FMCC is over 6M and FNMA is nearing 12M. Both stocks are trading up this morning.

With the release of their quarterly results upcoming, these next few months look to be an important determinant in the direction the companies will be taking. There has been a new company already registered that is being rumored to be the company that merges FMCC & FNMA, however, it will be up to the terms established in upcoming legislative bills that will determine whether or not this actually happens.

The last 5 minutes of trading:

FMCC traded 1M shares and is up to 11% early Wednesday

FNMA traded nearly 2M shares and is up 10% early Wednesday

Only 30 minutes into the trading day both stocks are experience an increased volume of shares. FMCC is over 6M and FNMA is nearing 12M. Both stocks are trading up this morning.

With the release of their quarterly results upcoming, these next few months look to be an important determinant in the direction the companies will be taking. There has been a new company already registered that is being rumored to be the company that merges FMCC & FNMA, however, it will be up to the terms established in upcoming legislative bills that will determine whether or not this actually happens.

The last 5 minutes of trading:

FMCC traded 1M shares and is up to 11% early Wednesday

FNMA traded nearly 2M shares and is up 10% early Wednesday

Subscribe to:

Posts (Atom)